Does your budget allow you to pay the bills AND put money into savings every month? If you want to become as “rich as a king,” start dealing with your budget more actively.

Limit your possibilities

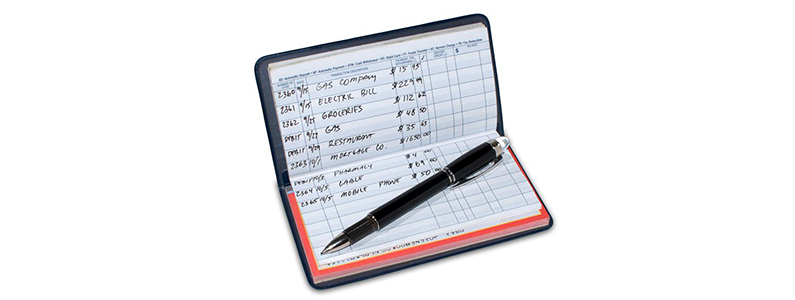

At the opening of a chess game, you have ten possible pieces that can move – the eight pawns and the two knights. Even players who haven’t studied the traditional openings can often think of a reasonable move. Likewise, your monthly budget should only have about ten general categories. With relatively few possibilities, deciding where to spend your money should not grow into a monumental task. That being said, after noting fixed expenditures such as rent, loan payments, etc., coordinate each of the remaining areas so that one doesn’t overtake the others.

Just as you probably wouldn’t start your chess game by moving one specific pawn up square by square, don’t let one particular expense in your budget outshine the others. Allot an hour or so each month to reviewing last month’s outflows and for planning the following month’s expenditures. If you’re on your own, block out the time so you don’t get distracted. If you’re married, do this exercise with your spouse. A couple should not have one person making all the spending decisions and simply informing the other one what to do.

Hammer out the details together, lest the efforts of one of you get torpedoed by the other’s spending. Should you call your better half every time you want to buy a sandwich? Probably not. Rather, develop an approach that works for your family situation. The two fundamental parts of the system to determine are the means of communication and the division of labor.

Communicating with your spouse about money

In the same way that a chess player will not make a move without knowing the location of each of the pieces on the board, neither should a couple make financial decisions without having all of the facts. When you work with your spouse, be sure that you not only gather all of the information about your accounts, but that you speak honestly and clearly about your own fears and desires.

Did you find this post useful? Please Tweet it to your friends.

To find out more about how even one small change to your budget can make a difference to your finances, click here.